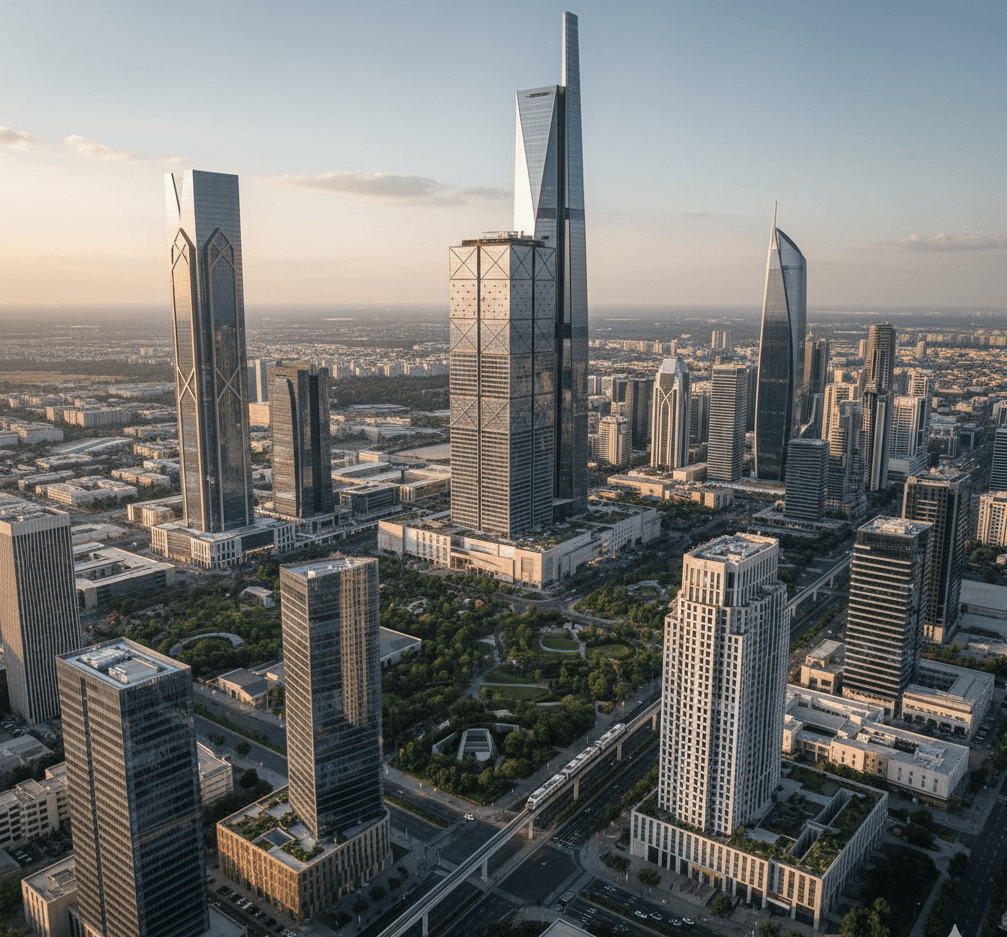

<The term «coding» has entered the real estate sector through the widest doors to correct the course of a number of trends; through it, the real estate is no longer a deaf mass that is difficult to divide, but a digital entity that can be measured and divided into very precise units. real estate tokenization represents a structural revolution in fragmenting large assets and transforming real estate from illiquid, illiquid, difficult-to-exit "hard assets" to flexible digital parts that can be traded instantaneously through blockchain. <This shift "thaws the ice" on big deals, injecting cash into the market by converting huge real estate value into small, affordable units (Tokens). This approach opens the door for small investors and individuals to own common stakes in commercial towers or logistics complexes. This approach opens the door for small investors and individuals to own common shares in previously inaccessible commercial towers or logistics complexes, enhancing financial stability and creating a smart real estate market characterized by transparency and fairness in the distribution of opportunities, and the real estate tokenization market may turn into a private exchange that revives hopes of investing with large owners shoulder to shoulder.

<On the other hand, tokenization provides a "double benefit" to large owners and investors by enabling them to systematically "partially exit»; instead of waiting years to fully sell or operate a giant asset, they can monetize certain portions of it to benefit from immediate cash flows to be invested in new projects, without losing overall control of the asset This balance between attracting retail capital and providing exit flexibility for large developers accelerates the real estate capital cycle, reduces recessions, and transforms real estate from a «locked-in» investment to a dynamic engine that supports the vitality of the digital economy in accordance with the objectives of the Kingdom's Vision 2030.

Editor-in-Chief